Skip to main content

GAO-22-104527 Published: May 26, 2022. Publicly Released: May 26, 2022.

Companies increasingly use numeric scores to predict how consumers will behave. Scores are based on hundreds of pieces of information about a person's purchases, consumer characteristics, and more. Scores are used to target ads, to help companies collect debts from consumers, to assess the likelihood of criminal behavior and flight risk, and more.

Unlike traditional credit scores, these scores may not be subject to consumer protection laws that seek to assure fair and transparent treatment. Consumers are generally unaware of how they're scored. We urged Congress to consider a consumer right to view and correct this data and more.

Key Ways Consumer Scores Are Used

What GAO Found

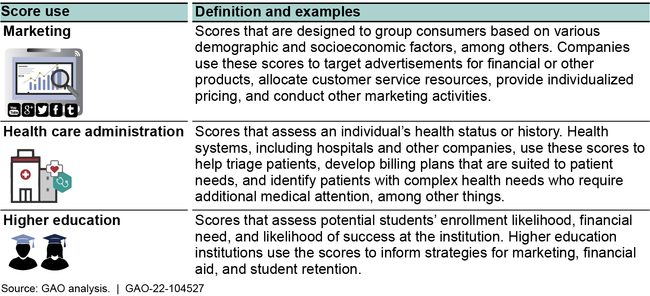

Consumer scores are indicators that group consumers based on their past actions and characteristics. Score creators use public records and nonpublic information such as purchase histories to create scores. Businesses and other entities use these scores to segment or rank individuals to predict how they will behave in the future. For example, businesses use certain scores to target advertising toward consumers most likely to purchase a particular product or service. Consumers may benefit from such scores by receiving targeted discounts or deals that they might not have otherwise received. Consumer scores have a variety of uses, although the full range of uses is unknown. GAO identified a number of score uses, including those in the figure below.

Selected Ways That Consumer Scores Are Used

The risks that consumer scores can pose include potential bias and adverse effects, and the scores generally lack transparency. The data used to create scores may contain racial biases—for example, one study found Black patients were assigned lower risk scores than White patients with the same health care needs, predicting less of a need for a care management program. The use of consumer scores can also have potential negative outcomes for some consumers, who may be charged higher prices or targeted for less desirable financial products. Further, consumers are generally unaware of the ways in which they are scored—which prevents them from knowing how their personal information is being used and responding to negative consequences.

No federal law expressly governs the creation, sale, and use of all consumer scores. Federal consumer protection laws can help to ensure that consumer scores are based on accurate information and used in a fair and transparent manner, but these laws only apply in certain circumstances. For example, whether a law applies to a particular score may depend on the information used to create the score, the source of the score, or the purpose for which the score is used. Without congressional consideration of whether consumer scores should be subject to additional consumer protections, consumers may continue to be at risk of being adversely affected by the use of these scores and may have limited options for recourse.

Why GAO Did This Study

The growing use of consumer scores to make decisions affecting consumers has raised questions among some in Congress and others about their usage and potential risks. Scores are generated using various pieces of information about consumers, which can include public data. Some may derive from complex methodologies using technologies such as artificial intelligence.

GAO was asked to review how predictive consumer scores are used and regulated. This report examines (1) how such scores are used, (2) the potential risks to consumers, and (3) federal consumer protections for scores. The review is focused on selected types of scores, some of which may fall outside of the Fair Credit Reporting Act. GAO analyzed publicly available information from the websites of a nongeneralizable sample of 49 consumer scores, selected based on literature reviews and stakeholder interviews; reviewed studies by academics and consumer advocates; interviewed score creators, industry organizations, consumer advocates, and federal officials; and reviewed applicable laws and regulations.

Recommendations

Congress should consider implementing appropriate consumer protections for consumer scores beyond those currently afforded under existing federal laws. Among the issues that should be considered are the rights of consumers to view and correct data used in the creation of scores and to be informed of scores' uses and potential effects.

Matter for Congressional Consideration

| Matter | Status | Comments |

|---|---|---|

| Congress should consider determining and implementing appropriate consumer protections for consumer scores beyond those currently afforded under existing federal laws. Among the issues that should be considered are the rights of consumers to view and correct data used in the creation of scores and to be informed of scores' uses and potential effects. (Matter for Consideration 1) |

Open <label class="status-code-label">Open</label><p class="status-code-description"><p>Actions to satisfy the intent of the recommendation have not been taken or are being planned, or actions that partially satisfy the intent of the recommendation have been taken.</p></p> |

When we confirm what actions the agency has taken in response to this recommendation, we will provide updated information. |

Full Report

Test scoresConsumersConsumer protectionStudentsPersonally identifiable informationHealth careCredit scoresFinancial assistanceIdentity verificationCredit cards

"used" - Google News

May 26, 2022 at 10:50PM

https://ift.tt/8oE2AYH

Consumer Protection: Congress Should Consider Enhancing Protections around Scores Used to Rank Consumers - Government Accountability Office (.gov)

"used" - Google News

https://ift.tt/xbsMVWn

https://ift.tt/ABIRe4h

Bagikan Berita Ini

0 Response to "Consumer Protection: Congress Should Consider Enhancing Protections around Scores Used to Rank Consumers - Government Accountability Office (.gov)"

Post a Comment