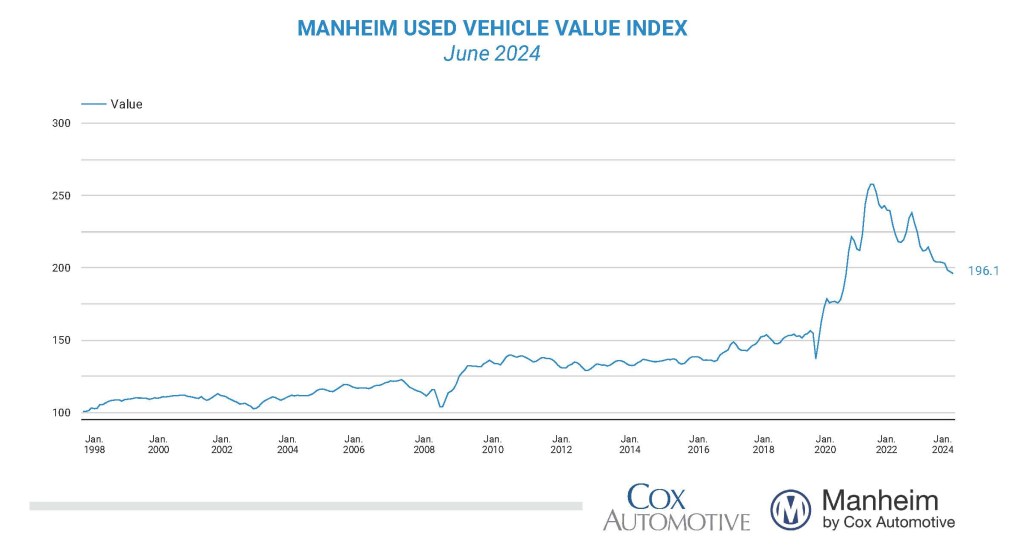

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were down in June compared to May. The Manheim Used Vehicle Value Index (MUVVI) fell to 196.1, a decline of 8.9% from a year ago. The seasonal adjustment to the index mitigated the impact on the month, resulting in values that declined 0.6% month over month for the second time in a row. The non-adjusted price in June decreased by 2.2% compared to May, moving the unadjusted average price down 10.0% year over year.

“Wholesale value declines have been stronger than we normally see for much of the last two months,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “However, even though much of the industry was feeling the retail sales disruptions caused by the CDK outages in the latter part of the month, Manheim started to see wholesale price declines decelerate, ending the month at a seasonally normal pace. Sales conversion is currently running several points above the previous three years, including 2021, indicating that buyer demand is relatively strong despite all the uncertainty in the market.”

In June, Manheim Market Report (MMR) values saw weekly decreases above long-term average declines, with the first half of the month showing stronger depreciation while the last week slowed noticeably. Over the last four weeks, the Three-Year-Old Index decreased an aggregate of 1.5%, including a decline of only 0.2% in the last week of the month. Those same four weeks delivered an average decrease of 0.5% between 2014 and 2019, showing that depreciation trends are currently running higher than long-term averages for the year.

Over the month of June, daily MMR Retention, which is the average difference in price relative to the current MMR, averaged 97.8%, meaning market prices stayed below MMR values again this month. Against May, valuation models in June moved down a point on MMR retention. The average daily sales conversion rate rose to 57.4%, a rise over the previous month and higher than is normally seen at this time of year. For comparison, the daily sales conversion rate averaged 51.4% in June over the past two years.

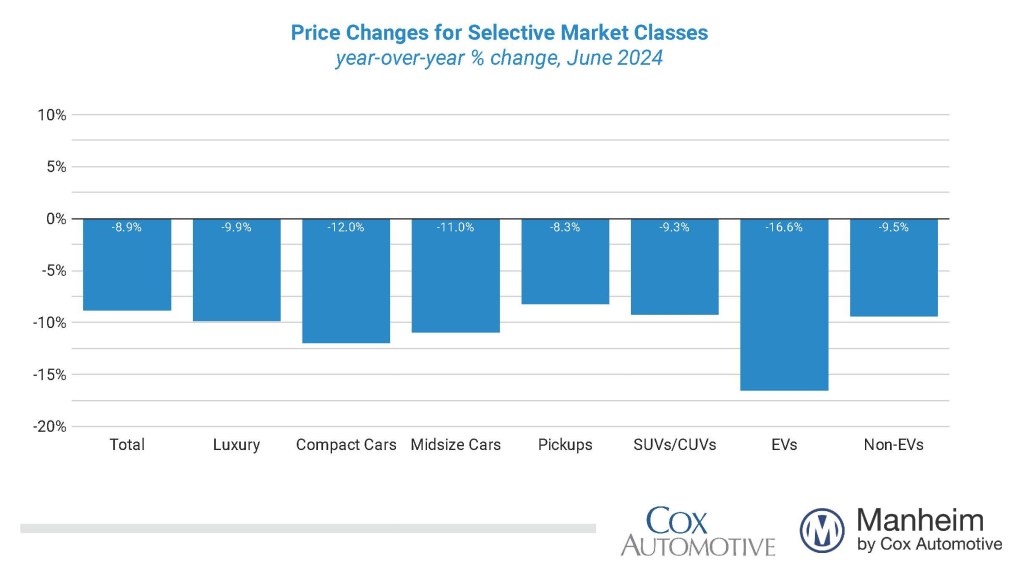

The major market segments all experienced seasonally adjusted prices that were down year over year in June. Compared to June 2023, pickups were the only segments that outperformed the industry, down 8.3% on the year. SUVs declined by 9.3% year over year, luxury fell 9.9%, midsize cars were down 11.0%, and compact cars were again the worst-performing segment, falling by 12.0% against last year. Compared to the previous month, SUVs show the best results, rising by 0.3% against May, and compacts fell just 0.4%, less than the industry average of down 0.6%. Performing worse than the industry, midsize cars fell by 0.8%, luxury was down 0.9%, and pickups declined the most against May, falling by 1.4% for the month.

Seasonally adjusted electric vehicle (EV) values for June 2024 were down 16.6% compared to June 2023, while non-EVs were down 9.5% for the same period. Compared to May, seasonally adjusted EV values continued to decline more than the market overall, falling by 6.5% in June, while non-EVs declined only 0.3% over the same period.

Retail Used-vehicle Sales Decreased in June

Assessing retail vehicle sales based on observed changes in units tracked by vAuto, initial estimates indicate that retail used-vehicle sales in June were down 5% compared to May but up 3% year over year. The average retail listing price for a used vehicle was down 1% over the last four weeks.

Using estimates of retail used days’ supply based on vAuto data, an initial assessment indicates June ended at 48 days’ supply, up two days from 46 days at the end of May and down one day from June 2023 at 49 days.

New-vehicle sales in June were down 3.4% from last year, and volume declined 7.6% from May as the industry impact from the CDK outage decreased the pace of sales from earlier in the month. The June sales pace, or seasonally adjusted annual rate (SAAR), came in at 15.3 million, down 0.4 million from last year’s pace and down from May’s 15.9 million level.

Combined sales into large rental, commercial, and government fleets decreased 8.7% year over year in June. Including an estimate for fleet deliveries into dealer and manufacturer channels, the remaining new retail sales were estimated to be down 0.4% from last year, leading to an estimated retail SAAR of 12.7 million, lower by 0.2 million from last year’s pace and down from May’s 13.0 million level. Fleet share was estimated to be 17.1%, down from last year’s 19.6% share.

Rental Risk Prices and Mileage Showed Declines in June

The average price for rental risk units sold at auction in June declined 14.8% year over year. Rental risk prices decreased by 5.3% compared to May. Average mileage for rental risk units in June (at 49,400 miles) fell significantly against the prior year, down 12.8% for the month against last year’s level. For the month of June, rental unit average mileage was down 12.5% month over month.

Measures of Consumer Confidence Were Mixed in June

The Conference Board Consumer Confidence Index® declined 0.9% in June, as views of the future declined more than views of the present improved. Consumer confidence was down 8.8% year over year. Plans to purchase a vehicle in the next six months declined compared to May but was higher than June last year. According to the sentiment index from the University of Michigan, consumer sentiment declined 1.3% in June compared to May but was up 6.2% year over year. The median consumer expectation for inflation in a year declined to 3.0%, the lowest level in three months; but the expectation for five years was steady at 3.0%. The consumer’s view of vehicle-buying conditions declined to the lowest level since November as the view of interest rates and prices deteriorated. The daily index of consumer sentiment from Morning Consult was less volatile in June and ended up 0.6%, leaving the index up 3.0% year over year. Gas prices declined in June, but gas prices rose in the last week of the month. The national average price for unleaded gas, according to AAA, was down 1.5% from the end of May to $3.49 per gallon as of June 30, which was down 1% year over year but up 1.2% over the last week.

The quarterly call will be held on Tuesday, July 9, 2023, at 11 a.m. EDT. Register to attend.

The next complete suite of monthly MUVVI data will be released on August 7, 2024.

For questions or to request data, please email manheim.data@coxautoinc.com. If you want updates about the Manheim Used Vehicle Value Index, as well as direct invitations to the quarterly call sent to you, please sign up for our Cox Automotive newsletter and select Manheim Used Vehicle Value Index quarterly calls.

Note: The Manheim Used Vehicle Value Index was adjusted to improve accuracy and consistency across the data set as of the January 2023 data release. The starting point for the MUVVI was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, whereas prior reports had 1995 as the baseline of 100. All monthly and yearly percent changes since January 2015 are identical. Learn more about the decision to rebase the index.

"used" - Google News

July 09, 2024 at 08:39PM

https://ift.tt/192fXsv

Wholesale Used-Vehicle Prices Declined in June - Cox Automotive

"used" - Google News

https://ift.tt/cJ0opVa

https://ift.tt/Yrw5xgS

Bagikan Berita Ini

0 Response to "Wholesale Used-Vehicle Prices Declined in June - Cox Automotive"

Post a Comment