Later this month, Berman Auto Group will host what has become a rare occurrence at a car dealership in the past two years: a sales event.

The company in April bought about 150 vehicles when it opened another site in metropolitan Chicago, pegging the prices to a market benchmark that had skyrocketed since 2020. Vice-president Ross Berman then watched helplessly when used car prices began to fall, eating into the dealer’s profit margins for the vehicles he had not yet sold.

“They’re a sign to me of how much has changed over the past few months,” Berman said. For Black Friday, the shopping bonanza after the Thanksgiving holiday, he is offering zero per cent financing. “We want to sell these cars.”

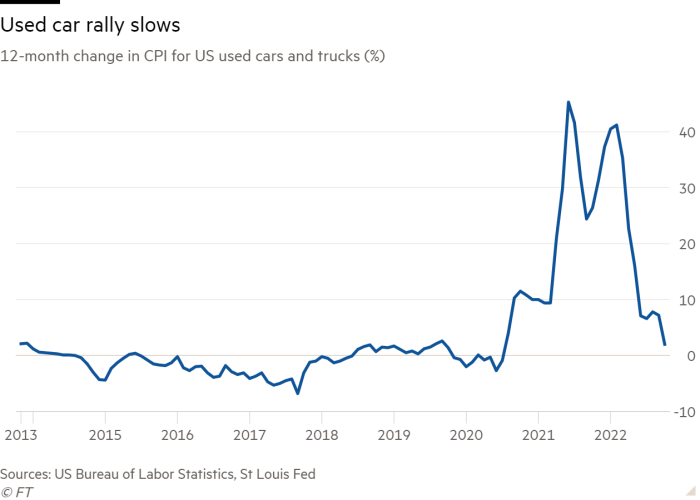

Rising used car prices helped drive the worst US inflation in a generation. Government statistics show prices are 49 per cent higher than in June 2020 in the early days of the pandemic.

While prices are still high by historical standards, the gains are sharply decelerating. In October, they rose 2 per cent year on year, the US Bureau of Labor Statistics reported last week, down from an annual rate of more than 40 per cent in early 2022. At the online marketplace Cars.com, the median price for a used vehicle in October decreased more than 3 per cent from a year earlier to $23,499.

The decrease has ramifications for manufacturers, dealers, lenders, shoppers and potentially the wider economy as inflation shows signs of cooling off.

The price rise of the past two years was fuelled by a scarcity of new cars and trucks, as a worldwide shortage of semiconductor chips limited the number of vehicles that carmakers could produce. The smaller supply of new vehicles forced more consumers to turn to the used market, including rental car companies hungry to replenish fleets they had shrunk during the shutdowns of the Covid-19 pandemic.

Now, an increased supply of new cars and trucks, plus rising interest rates as the Federal Reserve fights inflation, are causing demand for used cars to ebb. Dealers are cutting prices to keep car payments attractive to shoppers as higher borrowing costs make financing less affordable.

“The Federal Reserve made a decision to raise interest rates, and for better or worse, it’s doing its job,” Berman said. “It’s basically slowing consumer demand. The same vehicle at the same price today is going to cost the customer a lot more. That, by default, lowers demand on those cars.”

The declining prices of used cars are felt by family-owned dealers and large chains alike. Two publicly traded dealers, Carvana and CarMax, both outperformed the S&P 500 stock index in 2020 and 2021, but this year CarMax’s stock price has dropped 44 per cent while Carvana’s plummeted 96 per cent.

S&P Global recently changed its outlook on Carvana to negative because of weakening profit margins, cash flows and liquidity. More than half the dealer’s gross profit per unit comes from selling loans and other products, but Carvana is poised to lose a share of this business.

“With rising interest rates, it is more difficult for Carvana to compete with the large banks that can keep loan rates low,” said S&P analysts David Binns and Nishit Madlani.

The company would need to seek fresh capital to maintain liquidity in 2024, they added.

Falling used vehicle prices traditionally had been “the canary in the coal mine” for new cars and trucks, said Steve Brown, an analyst at Fitch Ratings. They signalled declining demand for new vehicles, forcing price cuts and in turn lower production by manufacturers.

That pattern may no longer hold. US carmakers made, on average, about 11.2mn vehicles a year for the five years preceding the pandemic, said Kristin Dziczek, an automotive policy adviser at the Federal Reserve Bank of Chicago.

But the chip shortage curtailed production: They made just below 9mn a year in 2020 and 2021 and are forecast to produce less than 10mn this year. Because manufacturers have built fewer new vehicles in the past two years than consumers want to buy, falling used vehicle prices may not translate into lower prices for new cars and trucks.

Carmakers have also spent the past two years allocating scarce chips to the most expensive versions of their most profitable vehicles, essentially abandoning the low end of the market. Less affluent customers moved into the used vehicle market. Carmakers may be less inclined to cut prices even as supplies rebound “because the low-end buyer is out of the market”, Brown said.

At wholesale auctions, buyers are no longer willing to pay what sellers are demanding, said Omair Sharif, president of Inflation Insights, a forecasting and analysis group. The US consumer price index for used cars fell 2.4 per cent from September to October.

With used vehicles making up 5 per cent of the basket of goods used to track inflation, October’s decline in used vehicle prices subtracted more than a tenth off the core inflation rate, Sharif said.

“It’s going to become an anchor and pull down on the core rate as we move forward,” he said. While everyday purchases such as groceries influence people’s perception of inflation more, “even if you don’t buy a used car every week, it still helps in terms of seeing that the data is coming down”.

"used" - Google News

November 16, 2022 at 12:01PM

https://ift.tt/2kMKYAy

Slowdown in US used car market contributes to cooling inflation - Financial Times

"used" - Google News

https://ift.tt/j2UxEim

https://ift.tt/9woVikf

Bagikan Berita Ini

0 Response to "Slowdown in US used car market contributes to cooling inflation - Financial Times"

Post a Comment