The Cheesecake Factory Incorporated (NASDAQ:CAKE) shareholders should be happy to see the share price up 15% in the last quarter. But over the last half decade, the stock has not performed well. After all, the share price is down 26% in that time, significantly under-performing the market.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Our analysis indicates that CAKE is potentially undervalued!

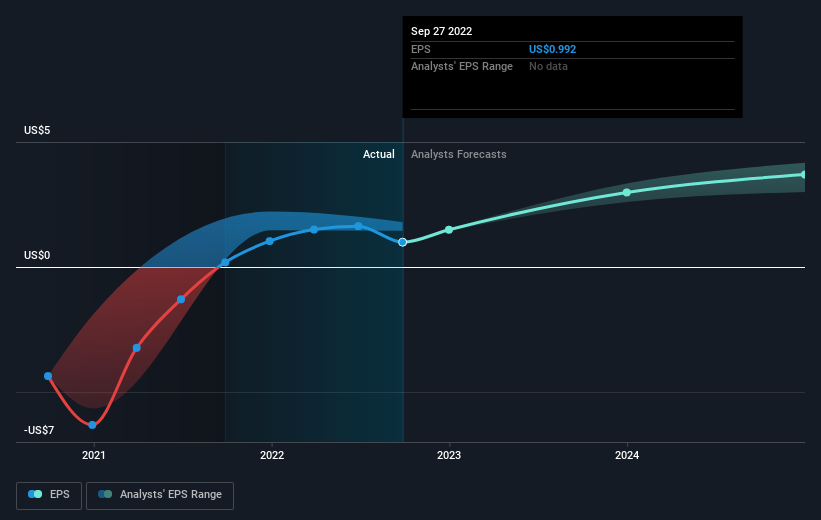

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years over which the share price declined, Cheesecake Factory's earnings per share (EPS) dropped by 19% each year. This fall in the EPS is worse than the 6% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Cheesecake Factory has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Cheesecake Factory's TSR for the last 5 years was -19%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Although it hurts that Cheesecake Factory returned a loss of 10% in the last twelve months, the broader market was actually worse, returning a loss of 19%. Given the total loss of 3% per year over five years, it seems returns have deteriorated in the last twelve months. While some investors do well specializing in buying companies that are struggling (but nonetheless undervalued), don't forget that Buffett said that 'turnarounds seldom turn'. It's always interesting to track share price performance over the longer term. But to understand Cheesecake Factory better, we need to consider many other factors. Even so, be aware that Cheesecake Factory is showing 3 warning signs in our investment analysis , you should know about...

Of course Cheesecake Factory may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Cheesecake Factory is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Read Again https://news.google.com/__i/rss/rd/articles/CBMikgFodHRwczovL3NpbXBseXdhbGwuc3Qvc3RvY2tzL3VzL2NvbnN1bWVyLXNlcnZpY2VzL25hc2RhcS1jYWtlL2NoZWVzZWNha2UtZmFjdG9yeS9uZXdzL3RoZS1wYXN0LWZpdmUteWVhcnMtZm9yLWNoZWVzZWNha2UtZmFjdG9yeS1uYXNkYXFjYWtlLWludmVzdNIBlgFodHRwczovL3NpbXBseXdhbGwuc3Qvc3RvY2tzL3VzL2NvbnN1bWVyLXNlcnZpY2VzL25hc2RhcS1jYWtlL2NoZWVzZWNha2UtZmFjdG9yeS9uZXdzL3RoZS1wYXN0LWZpdmUteWVhcnMtZm9yLWNoZWVzZWNha2UtZmFjdG9yeS1uYXNkYXFjYWtlLWludmVzdC9hbXA?oc=5Bagikan Berita Ini

0 Response to "The past five years for Cheesecake Factory (NASDAQ:CAKE) investors has not been profitable - Simply Wall St"

Post a Comment