jetcityimage/iStock Editorial via Getty Images

Wall Street has bet big on disinflation over the past 6 months, in the hopes that the Fed will "pivot" and return to rate cuts and quantitative easing and allow them to profit big on their speculative bets. Hair-triggered algorithms have bought hundreds of billions in stock on slightly better-than-forecasted data points, many of which have been subsequently revised worse. Nowhere is this more clear than in the monthly CPI reports, which have gone from an afterthought economic data release in years past to now being the main event, with market moves in excess of 3% routinely following CPI releases over the past year. The next installment of CPI is set to be released this week at 8:30 a.m. Eastern Time, on Wednesday, April 12. Then, traders will get insight into the path of consumer prices over the previous month.

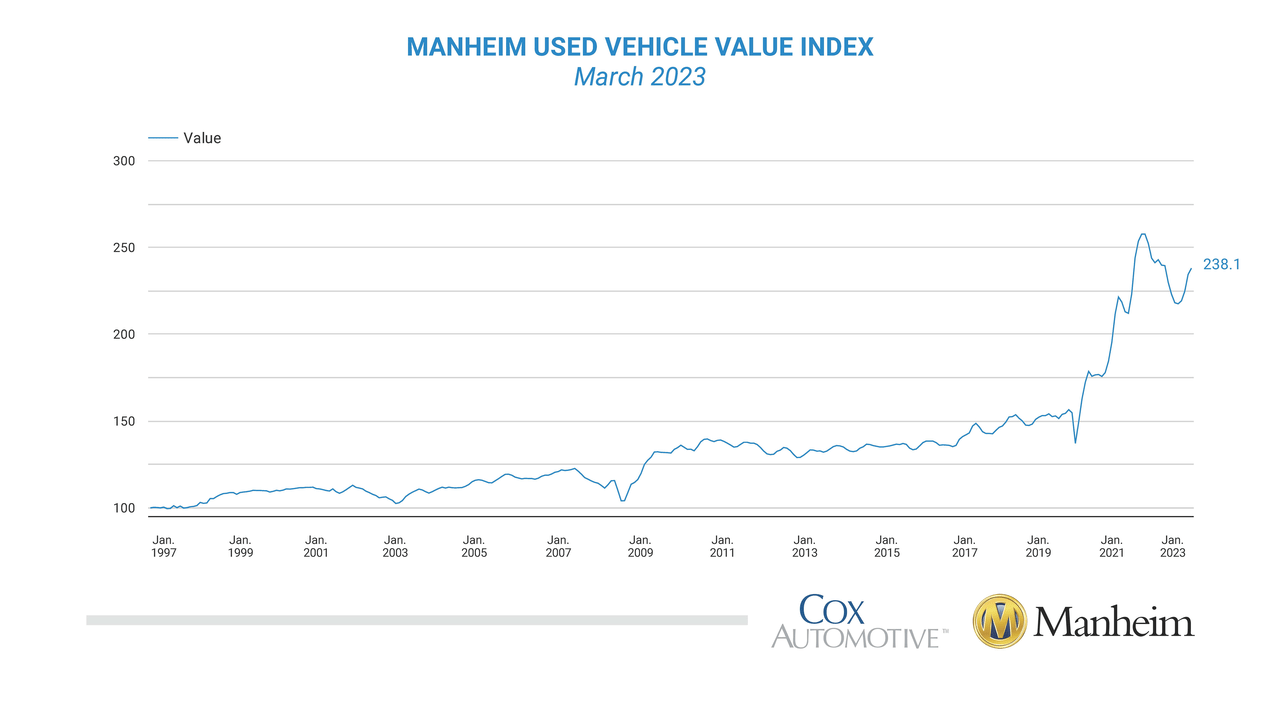

The inflation story so far in 2023 has been one of an easing of shortages in many categories of goods but rapid growth in inflation for services. However, there are some signs that the disinflation in goods is not as strong as it appears from the early data. Used cars have been a headache for the Fed throughout the pandemic, and they're shaping up to be here again. Specifically, data from auction house Mannheim shows that wholesale used car prices are up about 9% since November.

You can see here that used car prices skyrocketed during COVID, then fell, and now are surging yet again. If this is true, it's a big problem for the Fed's efforts to get inflation back down to its 2% target and indicates the need for more rate hikes and trouble for stocks.

Used Car Prices (Mannheim)

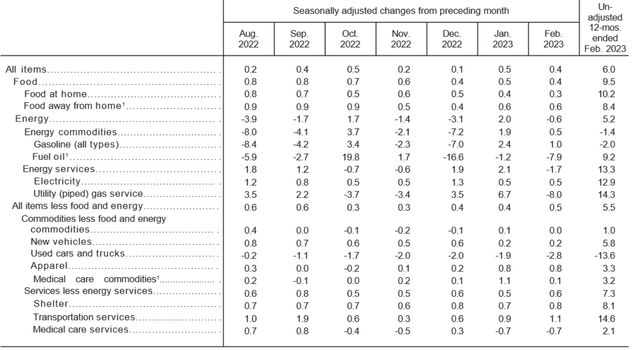

However, if you go to the actual CPI reports, you see none of this. According to the most recent CPI report, used car prices actually fell 2.8% month over month, which is a huge contradiction. This was enough to make CPI roughly 0.2% lower for the month vs. what the rise in Mannheim prices would have implied. 0.2% may not sound like much, but with algorithms buying and selling billions of dollars in stocks based on the results and what they imply about disinflation (or a lack thereof), it's worth digging into whether the data is actually saying what market participants believe it is.

February CPI (Bureau of Labor Statistics)

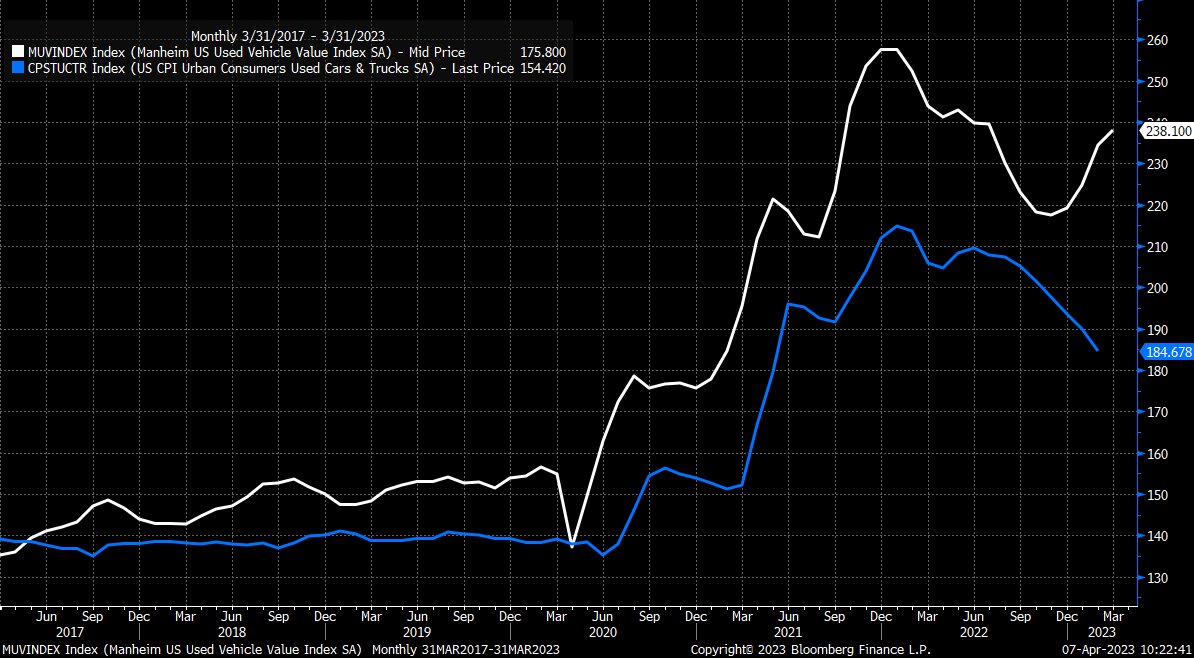

Why would Mannheim, which tracks transaction data from its wholesale auctions, be in such disagreement with the BLS, which tracks a sample of used car sales from J.D. Power? As you can see below, historically they track quite well. Until now.

Mannheim vs. CPI Used Car Prices (Bloomberg via Mott Capital)

Some theories:

- Since it takes a while for dealer wholesale sales to pass through to consumers, the Mannheim data could be early. You can clearly see this over the past three years, where spikes in wholesale prices were soon followed by spikes in retail prices.

- Alternatively, either data source could be wrong. I view the CPI as more likely to be wrong since apparently it's done with a small sample of 480 sales each month. Against roughly 3 million used car sales per month, that's a margin of error of roughly 5% at a 95% confidence interval. They may be more accurate than my first read, but this would seem to make used car data really noisy and prone to revisions.

- If both data sources are correct and wholesale used car prices are rising while retail prices are falling, then that implies that corporate profit margins are getting destroyed. If you're paying more for your inputs while demand from consumers is falling then you're in a tough spot. Maybe dealers chose to load up on inventory before tax-refund season, but if that's the case they're sacrificing on their margins!

None of these are particularly good for the economic outlook.

If wholesale used car prices are the canary in the coal mine for another inflation spike, then the Fed is behind the curve yet again on inflation. There's some evidence that this may be happening. OPEC is cutting back production, car manufacturers are cutting back production, and consumers aren't respecting rate hikes and are ramping up borrowing, then the Fed would need to hike more to avoid another out-of-control inflation spike. This is not priced into stocks. If CPI comes in hot and is revised higher again, it's more or less the same deal, meaning the Fed is going to have to hike much more than the market thinks and stay there.

What's perhaps the most interesting is the third possibility. A third possibility is that disinflation is really happening. However, the upshot is that supply chain shortages and inflation led to record profit margins for Corporate America. As these have eased, profit margins have started to compress. Rapid disinflation would likely lead to the opposite, meaning profit margins could get crushed. Economic pain points like rent and used car prices returning to normal levels relative to wages mean that corporate profits are not going to remain elevated. If you take the Mannheim data and CPI at face value, this is the story they're telling – that a huge compression in profit margins is happening for car dealers with retail prices falling but wholesale prices rising.

This squeeze isn't just happening at car dealers, but also at companies like Apple (AAPL), which has seen a face-ripping 28% rally in three months despite steadily falling earnings estimates. Something isn't quite right! Tesla (TSLA) is cutting prices as well, indicating some margin pressure that they'll need to make up by gaining market share. The equity market is acting as if soft landings are the norm, but meanwhile, the bond market is screaming for a recession. This is highly contradictory, and one group of traders is likely to be proven wrong. The broader S&P 500 (SPY) is up about 7% this year while earnings estimates are down. Again, something has to give.

The Overall Inflation Picture

Briefly handicapping CPI for this week – expectations are set for a 0.4% month-over-month increase in core CPI for March. The Cleveland Fed CPI nowcast is slightly higher at 0.45%. Inflation figures for Spain show core inflation holding steady at a 40-year high, the story is the same in Germany, while in Japan, inflation seems to have slightly cooled but remained too hot for comfort (albeit helped by subsidies).

I don't have a super strong opinion on whether CPI will come in hotter than expectations or not, but prices rising 0.4% per month (roughly 4.9% per year) is clearly too high. Absent some sort of massive uncontrolled bank failure in the next three weeks, the Fed will hike again, and if the inflation data is bad then they'll hike more. They've said this repeatedly, the market just doesn't respect them, so they've piled into pivot bets over and over again since the start of 2022 despite worsening fundamentals.

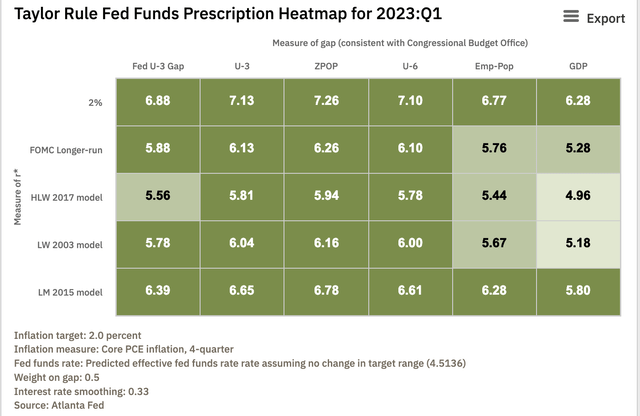

The Fed is still too much on the dovish side in my opinion, but modeling is showing that they're getting closer to where they need to be in terms of monetary policy.

Taylor Rule Calculator (Atlanta Fed)

Bottom Line

With the Fed funds rate at 4.75%-5.00% and the next meeting in early May, it's clear that they need to hike another quarter point at a minimum to prevent inflation from bubbling up again. However, the path from there is "data dependent." A nasty surprise in used car prices would indicate that the Fed is still somewhat behind the curve and would need to hike closer to 6% to finally bring inflation under control. With popular tech stocks and the S&P 500 priced near bubble levels, that may not be the news that bulls looking for a quick pivot were looking for. With that in mind, is it really worth rolling the dice on the market continuing to charge higher when money market funds are paying 5% on cash, risk free? There are some good value stocks out there if you're willing to dig, but the bar is pretty high with the risk-free rate where it is.

"used" - Google News

April 10, 2023 at 11:49PM

https://ift.tt/gF2Ab35

March CPI: An Inflation Puzzle In Used Cars With Huge Implications For Markets - Seeking Alpha

"used" - Google News

https://ift.tt/xz8YHZQ

https://ift.tt/glxk5OS

Bagikan Berita Ini

0 Response to "March CPI: An Inflation Puzzle In Used Cars With Huge Implications For Markets - Seeking Alpha"

Post a Comment