After a more than 250% gain since the March 23 lows of the last year, at the current price of $255 per share, we believe United Rentals Stock (NYSE: URI) is overpriced. United Rentals, the largest equipment renting company in the world offering services to construction and industrial companies, manufacturers, utilities, etc., has seen its stock rally from $71 to $255 off the recent bottom compared to the S&P which moved around 70% – the stock is leading the broader markets by a huge margin. That said, there is a mismatch between its stock and revenue growth – United Rentals top-line has fallen 5% to a consolidated figure of $8.7 billion for the last 4 quarters from the consolidated figure of $9.2 billion for the 4 quarters before that. However, the company has reported better than expected results in the third quarter of 2020 and has also raised its full-year 2020 revenue guidance, which is the main reason behind positive investor sentiment toward the stock.

United Rentals’ stock has surpassed the level it was at before the drop in February 2020 due to the coronavirus outbreak becoming a pandemic. This seems to make it expensive as, in reality, demand and revenues will likely be lower in 2020 than the previous year.

The company’s revenues grew around 16% from $8 billion in 2018 to about $9.4 billion in 2019, which translated into a 7% rise in the net income figure. The cost of revenues increased from 58% of revenues to 61% over the same period, partially offsetting the positive impact of higher revenues on the net income.

While the company has seen steady growth in revenue and earnings over 2018-2019, its P/E multiple has also increased. We believe the stock is overpriced and is likely to see some downside after the recent rally and the potential weakness from a recession-driven by the Covid outbreak. Our dashboard Buy Or Fear United Rentals Stock? has the underlying numbers.

United Rentals’ P/E multiple has changed from just below 8x in FY 2018 to around 11x in FY 2019. While the company’s P/E is close to 17x now, there is a downside risk when the current P/E is compared to levels seen in the past years – P/E multiple of around 11x at the end of 2019 and 8x at the end of 2018.

So Where Is The Stock Headed?

United Rentals nine months cumulative revenues for 2020 have decreased by 9% y-o-y, primarily due to a 10% decline in equipment rentals – the segment contributed around 85% of URI’s revenues in 2019. This decrease was due to the impact of the Covid-19 crisis on its clients in construction, manufacturing, and other industries, which reduced the demand for its equipment. However, as more and more people are vaccinated for Covid-19 and the economic condition improves, we expect the traditional industries to see some recovery, benefiting United Rentals’ top-line. That said, the revival in demand is unlikely to be immediate. It means that URI is likely to report negative revenue growth in the subsequent quarters as well. However, URI stock is trading 59% above its pre-Covid peak. Overall, we expect the drop in revenues to serve as a reality check for investors, reducing United Rentals’ stock price in the near future.

The actual recovery and its timing hinge on the broader containment of the coronavirus spread. Our dashboard Trends In U.S. Covid-19 Cases provides an overview of how the pandemic has been spreading in the U.S. and contrasts with trends in Brazil and Russia. Following the Fed stimulus — which set a floor on fear — the market has been willing to “look through” the current weak period and take a longer-term view. With investors focusing their attention on 2021 results, the valuations become important in finding value. Though market sentiment can be fickle, and evidence of an uptick in new cases could spook investors once again.

Trefis

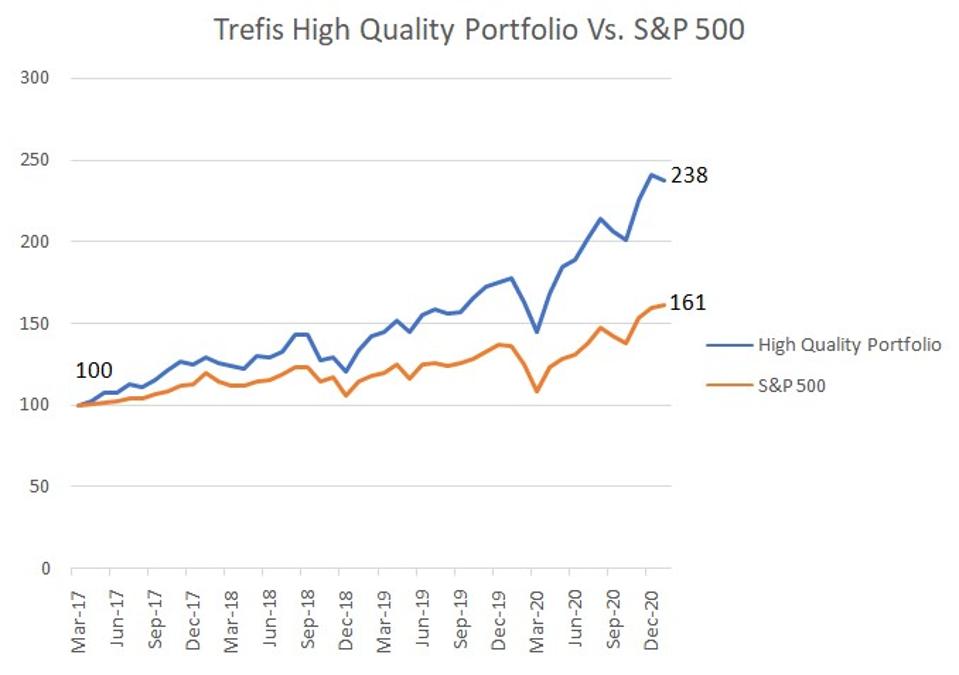

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio to beat the market, with over 100% return since 2016, versus 55% for the S&P 500. Comprised of companies with strong revenue growth, healthy profits, lots of cash, and low risk, it has outperformed the broader market year after year, consistently.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams

"expensive" - Google News

January 20, 2021 at 06:30PM

https://ift.tt/2M4Vyli

United Rentals Stock Looks Expensive At $255 - Forbes

"expensive" - Google News

https://ift.tt/2GwwnlN

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "United Rentals Stock Looks Expensive At $255 - Forbes"

Post a Comment