Nevada ranked the second highest auto insurance rates in the country, according to Insurify.

Used car prices are starting to edge down after soaring for years after the pandemic hit, and while the trend is a much-welcomed relief for buyers, it is also causing trouble for some consumers who purchased their vehicles at higher prices.

Edmunds' latest used vehicle report found a growing number of Americans are upside down on their auto loans as used prices decline, and the average amount consumers are underwater is at an all-time high.

Used vehicle prices have eased from a year ago, but the average amount consumers are upside-down on car loans hit a record high. (Steve Pfost/Newsday RM via Getty Images / Getty Images)

The report found the average transaction price (ATP) for all used vehicles declined to $28,371 in the fourth quarter of 2023, a 4.4% decrease from the same quarter the year before, when the ATP sat at $29,690.

At the same time, the percentage of new vehicle sales that had a trade-in with negative equity jumped to 20.4%, up from 17.7% in 2022 and 14.9% in 2021.

WAGES IN THE US ARE FALLING AT A ‘STRIKING’ PACE, INDEED SAYS

Now, the average amount consumers owe on upside down loans is at a record high of $6,064, up from $5,347 in fourth-quarter 2023 and $4,143 in 2021, the data found.

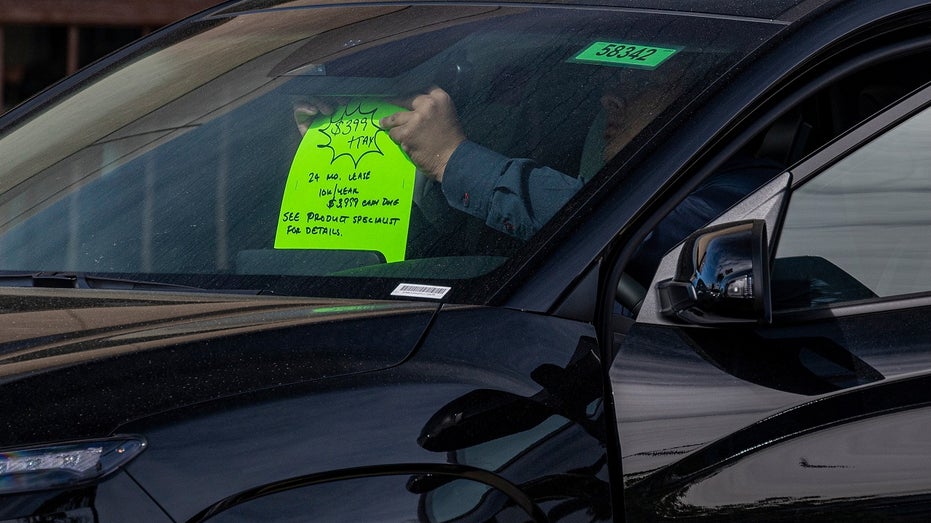

Used vehicle prices are finally coming down after soaring during the pandemic. (Photographer: David Paul Morris/Bloomberg via Getty Images / Getty Images)

"A storm is brewing in the used market as incentives and inventory continue to trickle back into the new vehicle market," said Ivan Drury, Edmunds' director of insights.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AN | AUTONATION INC. | 159.52 | +0.62 | +0.39% |

| CVNA | CARVANA CO. | 78.85 | -1.92 | -2.38% |

| KMX | CARMAX INC. | 80.84 | +1.02 | +1.28% |

"With demand for near-new vehicles on the decline, used car values are depreciating similarly to the way they did before the pandemic, and negative equity is rearing its ugly head," he added.

401(K) ‘HARDSHIP’ WITHDRAWALS SURGE TO ANOTHER RECORD AS HIGH INFLATION STINGS

Edmunds analysts found the consumers most vulnerable to falling underwater on their auto loans are those who purchased new vehicles for above sticker price, because those newer trade-ins are seeing the steepest decreases in value.

The consumers most at risk of being underwater on their car loans are those who purchased vehicles at above MSRP within the past few years. (Photo by Justin Sullivan/Getty Images / Getty Images)

The data shows that compared to the third quarter of 2022, when used vehicle values were at their peak, the ATP for 1-year-old vehicles last quarter was down $6,763 to $38,720. Two-year-old trade-ins fell to $32,583, a $3,294 decline.

For comparison, the ATP for a decade-old trade-in fell to $12,477, a $1,304 decrease.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"During the last few years, consumers could jump into new car loans and their trade-ins were shielded from negative equity because some dealers, desperate for used inventory, were willing to pay near original purchase prices," Drury said.

He added, "These days, consumers need to be more careful — especially if they're trading in newer vehicles — because near-new cars are being hit the hardest by depreciation."

"used" - Google News

March 19, 2024 at 06:00PM

https://ift.tt/DYgvOwj

Americans increasingly upside down on auto loans as used car values fall - Fox Business

"used" - Google News

https://ift.tt/fV1nup5

https://ift.tt/EWi1GAg

Bagikan Berita Ini

0 Response to "Americans increasingly upside down on auto loans as used car values fall - Fox Business"

Post a Comment