Used-vehicle inventory opened March at the lowest level since October 2023, according to the Cox Automotive analysis of vAuto Live Market View data.

2.27M

Total Unsold

Used Vehicles

as of March 4, 2024

44

Days’ Supply

$25,151

Average Listing Price

70,053

Average Mileage

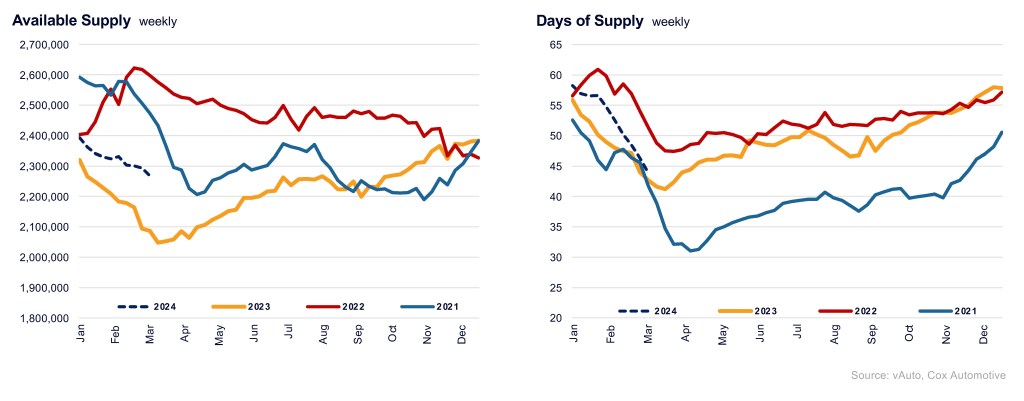

The total supply of unsold used vehicles on dealer lots – franchised and independent – across the U.S. stood at 2.27 million units as March opened, up nearly 9% from a year ago but down from the revised 2.33 million units at the start of February.

As spring fever and tax refund season began, we saw a healthy increase in new and used vehicle sales, which dramatically brought down days’ supply. Total days’ supply at the start of March fell to 44, compared with the revised 53 at the beginning of February, a 20% decline. It nearly matches what we saw a year ago, reflecting only a 2% increase year over year.

USED-VEHICLE INVENTORY VOLUME AND DAYS’ SUPPLY

Available inventory volume was up 9% year over year, while days’ supply remained up 2% year over year.

The Cox Automotive days’ supply is based on the estimated daily used retail sales rate for the most recent 30-day period, ending March 4, when sales were 1.55 million units, the highest for a 30-day period since April 2020. Used-vehicle sales in this timeframe were up 6% from a year ago.

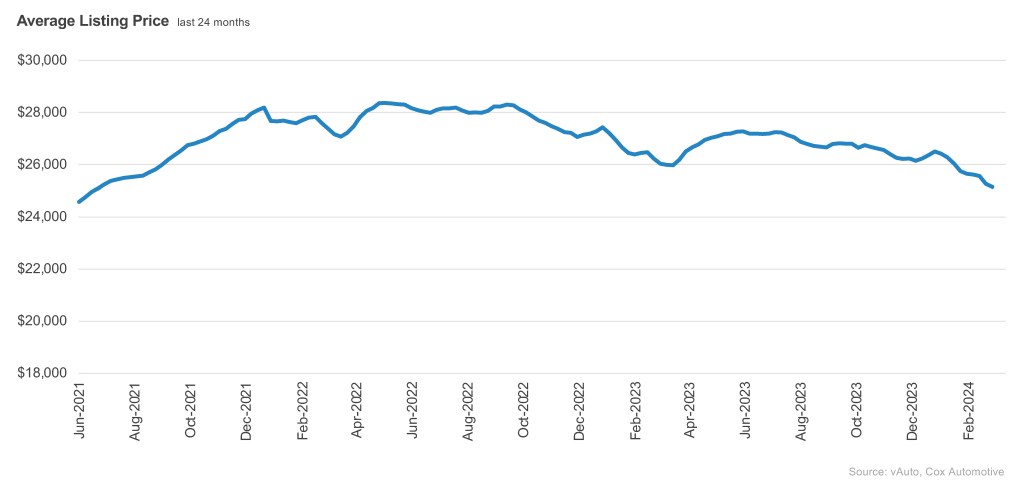

The average used-vehicle listing price was $25,151, down from a revised $25,653 at the start of February and down 3% from the same time in 2023.

AVERAGE USED-VEHICLE LISTING PRICE

Used-vehicle prices are now declining more slowly each week.

Interestingly, used vehicles priced above $35,000 had the highest sales, with 302,954 units sold, but days’ supply remains high at 52. In contrast, vehicles priced between $15,000 and $20,000 had the next highest level of sales, at 286,452 units sold, with 39 days’ supply. The healthy sales of lower-priced vehicles suggests that affordability remains challenging for many consumers, and supply is more constrained at lower price points. Domestics showed strength in the used-vehicle market as Ford and Chevrolet both outsold Honda and Toyota.

Erin Keating

Executive Analyst

Erin Keating is an Executive Analyst and Senior Director of Economic and Industry Insights at Cox Automotive. She has 25 years of experience in marketing and communications, including 10 years with Audi of America, where she also ran Audi Motorsport North America. With a focus on the wider industry, the individual automakers, and consumer shopping and buying behavior for new vehicles, Erin provides analysis and insights leveraging the breadth and depth of data from DRiVEQ, Cox Automotive’s data intelligence engine. Upon joining Cox Automotive, Erin was responsible for Enterprise Data Strategy – Partnerships. Erin is based in Atlanta.

"used" - Google News

March 15, 2024 at 11:36PM

https://ift.tt/bsEJH7Q

Spring Fever and Tax Refund Season Boost Used Retail Sales and Drop Days' Supply to 44 - Cox Automotive

"used" - Google News

https://ift.tt/ZTHsEgG

https://ift.tt/Jaj06Pg

Bagikan Berita Ini

0 Response to "Spring Fever and Tax Refund Season Boost Used Retail Sales and Drop Days' Supply to 44 - Cox Automotive"

Post a Comment